Five common mistakes to avoid for getting the best insurance for your needs on your minimum budget

January 30, 2022

Avoid these common mistakes to get the best insurance for your needs on your minimum budget.

Saving money makes sense. And shopping when looking for insurance is a great way to do it. Simply reducing coverage or eliminating key coverage altogether is like dieting without exercise — it just focuses on the numbers, not the results. In the event of a disaster, don't take the risk of serious insurance and don't insure much higher bills.

Here are five common mistakes people make with a flood, auto, home, and renters insurance, along with suggestions on how to avoid these problems and save money.

1. Secure the home for the value of the property rather than the cost of the renovation

When home prices fall, some homeowners may think they can lower their home insurance premiums. But this insurance is meant to cover the renovation costs, not the selling price of the house. You need to make sure you have enough insurance coverage to fully renovate your home and replace your assets - no matter what the real estate market does.

Save better: Increase your discount. increase from $500 to $1,000 can save you up to 25 % on your premium.

2. Choosing an insurance company is just a price

It is important to choose a company with competitive prices. However, make sure that the insurance company you choose is financially sound and offers good customer service.

A better way to save money: Check a company's financial health with independent rating agencies (some famous: A.M. Best, Moody's) and ask friends and family about their experiences with insurance companies. Choose an insurance company that meets your needs and handles claims fairly and effectively.

3. Take out flood insurance

Flood damage is not covered by standard homeowner and renter insurance policies. Insurance coverage is provided by the National Flood Insurance Plan (NFIP) and some private insurance companies. You may not know you are at risk from flooding, but remember that 25% of all flood deaths occur in low-risk areas. In addition, annual weather patterns—for example, spring runoff from snowmelt in winter—can cause flooding.

A better way to save: Before you buy a home from NIV, check if the home is in a flood zone. If so, consider a lower-risk area. If you already live in a flood-prone area, try to reduce the risk of flood damage and get flood insurance.

4. Buy only the amount legally required for your vehicle

The result is - at least what you can legally avoid. So if you only buy the minimum amount of debt, you'll likely end up paying more out of pocket later. And if you're sued, those fees could endanger your financial well-being.

Save Better: Consider a comprehensive and/or collision damage waiver for older cars under $1,000. The insurance industry and consumer organizations generally recommend a minimum of $100,000 for personal injury coverage per person and $300,000 per accident.

5. Don't buy renters insurance

If you have to move because of an insured event, such as a fire or storm, homeowners insurance will cover the extra cost of your life. Equally important, it protects against liability if someone in your home suffers damage and decides to sue.

A better way to save: Check out multi-policy discounts. Purchasing multiple insurance policies from an insurance company, such as B. rental, car, and life insurance, usually saves money.

Related Articles

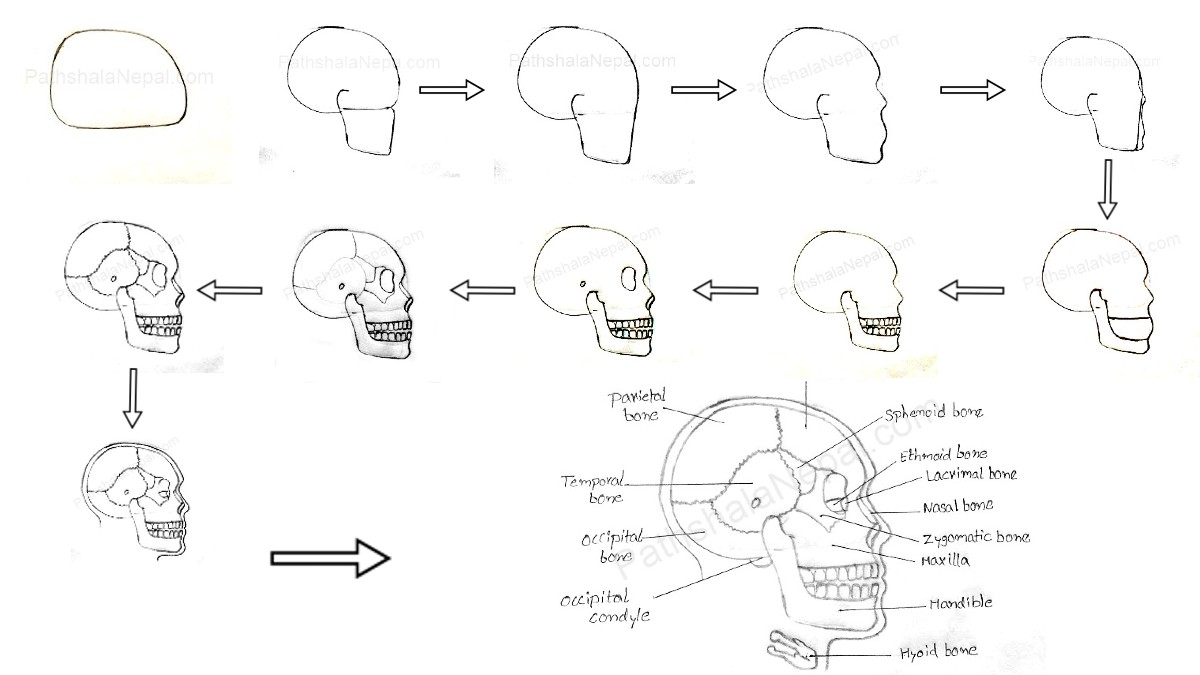

Why should we choose “Doctor” as a career?

When applying to the course of Medical, it is necessary to consistently and effectively answer the question “why do you want to become a doctor?”. in your personal statement. Then you have to answer the […]

Trending Articles

New price list of books form class 1 to 12 for BS 2080

Curriculum development center Sanothimi Bhaktapur under the Ministry of Education, Science, and Technology has released the price of new books from class 1 to class 12 for the educational year 2080. The price is only […]

Popular Tags: 7 Days

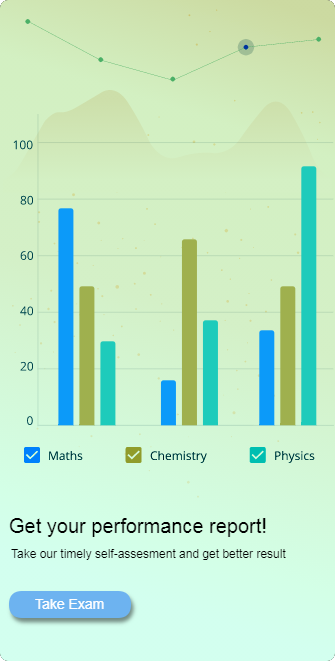

Upcoming MCQs

Computer Fundamental Multiple Choice Questions Exam Free

- 2022-03-20 12:45

- 60 Mins

- 12 Enrolled

- 25 Full Marks

- 10 Pass Makrs

- 25 Questions