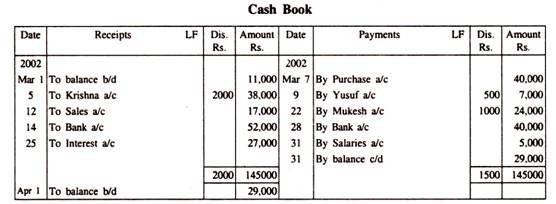

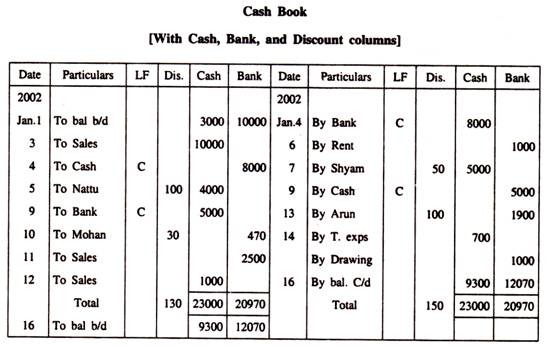

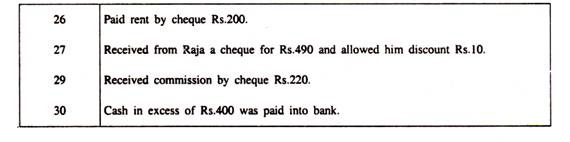

A contra entry is an entry that is recorded to reverse or offset an entry on the other side of an account. If a debit entry is recorded in an account, it will be recorded on the credit side and vice-versa.

For example, a company withdraws cash from the bank account to meet its daily expenses, and this entry is recorded as follows: cash Account is debited while the Bank account is credited.

Cheque receipt voucher prepared today for cheque dated01/11/2013.

the contra entry should be as follows;

Dr. Post dated cheque Cr.

Post-dated cheque.

custody in01/11/2013 Dr.

Banks A/C.

Cr.

Customer A/C Dr.

Post-dated cheque custody Cr.Post dated cheque so the contra A/C is an Account used to record contingent assets or liabilities for controlling purposes only, while preparing financial statements the effect of contra A/C should be zero, your responsibility as an accountant is to present it fairly to the external auditor as an advantage of maintaining internal control over the area under auditing.